20 Sep Interest Rates, Its Impact On the Market

The Impact of Interest Rates on Selling Your Home: How Fluctuating Rates Affect the Housing Market and Sales

Post 1 of 2

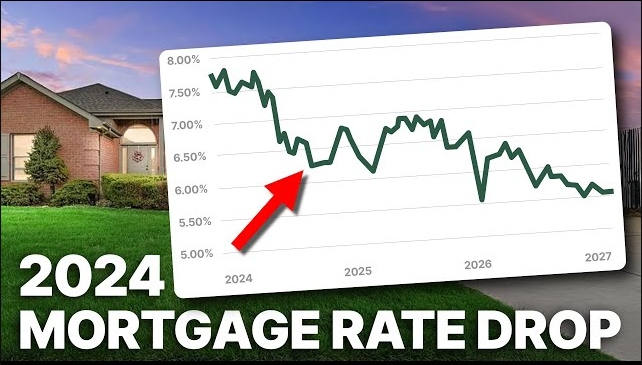

With the Federal Reserve lowering the Fed Fund rate by 0.25% this week, and signaling more rate cuts to come over the next year, its probably a good time to discuss the historical trends Interest rates play in the Housing market and what that means for 2025 and beyond.

Interest rates play a crucial role in shaping the dynamics of the real estate market, affecting everything from home prices to buyer and seller behavior. Whether you’re looking to sell a home in a low-interest-rate market or navigating the challenges of higher rates, understanding how fluctuating interest rates have historically influenced supply and demand is critical to achieving a successful sale. In this blog post, we’ll explore how changing interest rates affect the housing market, the behavior of buyers and sellers, and how supply and demand conditions shift as rates rise and fall, as well as how different this last higher interest rate cycle has been from the typical trend.

1. Understanding the Historical Relationship Between Interest Rates and the Housing Market

Interest rates dictate the cost of borrowing, which directly influences how much buyers can afford to pay for homes. When rates are low, mortgages become more affordable, leading to increased buyer demand. Conversely, when rates rise, borrowing costs increase, which can dampen demand and slow down home sales. For sellers, knowing how these fluctuations affect market conditions can help set the right pricing strategy and understand buyer motivations.

Low Interest Rates:

- Buyers: Low interest rates lower the cost of borrowing, meaning that buyers can afford higher-priced homes or enjoy lower monthly payments on their mortgages. This increase in affordability often leads to greater buyer demand, creating a competitive market.

- Sellers: In a low-rate environment, sellers benefit from the larger pool of buyers who are eager to take advantage of favorable rates. Homes tend to sell quickly, often for higher prices, due to the increased competition among buyers.

High Interest Rates:

- Buyers: When interest rates rise, the cost of mortgages increases, and many buyers find it harder to qualify for loans or are forced to scale back their home purchases. This decreases demand, particularly among first-time homebuyers or those with limited budgets.

- Sellers: For sellers, higher rates often mean fewer buyers and a slower sales process. Homes may take longer to sell, and sellers may need to price more competitively to attract buyers who are grappling with higher borrowing costs.

2. The Buyer Side: How Interest Rates Affect Demand

Low-Interest-Rate Markets: Increased Buyer Demand

In a low-interest-rate market, buyers are motivated to take advantage of the reduced cost of borrowing. A lower mortgage rate can translate into significant long-term savings, making homeownership more appealing. As a result, demand for homes increases, often leading to bidding wars and homes selling above asking price.

Key Factors Driving Buyer Demand in Low-Rate Markets:

- Affordability: Lower monthly mortgage payments mean that buyers can afford more expensive homes without stretching their budgets. This increases the overall purchasing power of buyers, making even higher-priced homes accessible.

- Investor Activity: Low rates also encourage real estate investors to enter the market, as the cost of financing properties becomes more attractive. This further drives demand, especially in markets with a strong rental or vacation home market.

- FOMO (Fear of Missing Out): Low interest rates can create urgency among buyers. The fear of rates rising in the future pushes potential buyers to act quickly, further driving demand and competition in the market.

High-Interest-Rate Markets: Decreased Buyer Demand

When interest rates rise, buyer demand typically drops. The cost of financing a home increases, making homes less affordable. Buyers become more cautious, particularly if they are stretching their budgets to afford higher home prices or have less flexibility in monthly payments.

Key Factors Reducing Buyer Demand in High-Rate Markets:

- Higher Monthly Payments: As interest rates rise, the cost of mortgages increases, reducing the amount buyers can borrow. For example, a small increase in the interest rate can add hundreds of dollars to a monthly mortgage payment, pricing some buyers out of the market.

- Tighter Mortgage Qualification: In a high-rate environment, lenders may tighten borrowing standards, requiring higher credit scores, larger down payments, or stricter income requirements. This reduces the pool of qualified buyers and further cools demand.

- Waiting Game: Many buyers may choose to wait for interest rates to drop before purchasing a home, believing that they’ll get a better deal in the future. This further suppresses demand and leads to longer market times for homes.

3. The Seller Side: How Interest Rates Affect Supply

Low-Interest-Rate Markets: Seller’s Advantage

In a low-interest-rate environment, sellers generally have the upper hand. High buyer demand leads to a supply shortage, creating favorable conditions for sellers. Homes tend to sell quickly, and sellers may receive multiple offers, often driving up the final sale price.

Key Factors Supporting Seller Activity in Low-Rate Markets:

- Increased Competition: With more buyers in the market, competition for homes intensifies. Sellers may benefit from bidding wars, allowing them to achieve higher sales prices and negotiate favorable terms.

- Quicker Sales: Homes tend to spend less time on the market in low-rate environments, as buyers are eager to lock in a low interest rate. This can be advantageous for sellers who want to close quickly and move on to their next property.

- Upgrading Opportunities: Low interest rates make it easier for sellers to upgrade to a new home, as they can secure favorable financing on their next property. This motivates sellers to list their homes and take advantage of the market conditions.

High-Interest-Rate Markets: Buyer’s Advantage

When interest rates rise, the market often shifts in favor of buyers. Fewer buyers are actively searching for homes, leading to a higher inventory of available properties. Sellers may need to adjust their expectations and adopt more flexible strategies to attract buyers.

Key Factors Affecting Sellers in High-Rate Markets:

- Longer Market Times: Homes may take longer to sell in a high-rate environment due to decreased buyer demand. Sellers may need to be patient and prepare for extended periods on the market.

- Price Adjustments: To attract buyers who are facing higher borrowing costs, sellers may need to price their homes more competitively. Overpricing a home in a high-rate market can lead to it sitting unsold for longer, ultimately leading to price reductions.

- Incentives and Concessions: Sellers in high-rate markets may need to offer incentives, such as covering closing costs, offering a home warranty, or making repairs to sweeten the deal and appeal to cash-strapped buyers.

4. Supply and Demand: How Fluctuating Interest Rates Shape Market Conditions

The basic economic principles of supply and demand are deeply influenced by interest rate fluctuations. When rates are low, demand typically outpaces supply, driving up home prices and leading to faster sales. On the other hand, when rates rise, supply often exceeds demand, and homes may sit on the market longer as buyers pull back.

Low Interest Rates: Seller’s Market

- High Demand: Low interest rates increase affordability, leading to a surge in buyer demand. The competition among buyers often results in homes selling quickly and for top dollar.

- Low Inventory: With so many buyers in the market, inventory can become tight. This creates a seller’s market where homes are scarce, further driving up prices and making it easier for sellers to negotiate favorable terms.

High Interest Rates: Buyer’s Market

- Low Demand: Rising rates make homes less affordable, reducing buyer demand. Fewer buyers are active in the market, giving those who are an advantage.

- Higher Inventory: As demand decreases, more homes are left unsold, leading to an increase in available inventory. This creates a buyer’s market, where buyers have more choices and greater negotiating power.

5. Strategies for Selling in Fluctuating Interest Rate Environments

Sellers need to adapt their strategies based on the current interest rate environment to maximize their chances of a successful sale.

In Low-Rate Markets:

- Price Competitively: While demand is high, setting a fair market price can lead to multiple offers and potentially drive up the sale price.

- Leverage Urgency: Buyers may be eager to lock in low rates, so offering a quick closing or reduced contingencies can attract motivated buyers.

- Highlight Affordability: Emphasize the low cost of financing and potential long-term savings when marketing your home.

In High-Rate Markets:

- Be Flexible: Offering to cover closing costs or make repairs can make your home more appealing to buyers.

- Price Realistically: Overpricing your home can lead to longer market times and the need for price reductions. Pricing in line with market conditions can attract more buyers.

- Prepare for a Longer Sale Process: In a high-rate environment, homes may take longer to sell, so be patient and adjust your strategy as needed.

Final Thoughts

Interest rates play a significant role in shaping the housing market, influencing both buyer demand and seller supply. For sellers, understanding how fluctuating interest rates affect market conditions is crucial to setting the right price, timing your sale, and negotiating favorable terms. Whether rates are rising or falling, being aware of the broader economic environment and how it impacts both buyers and sellers will help you make smarter decisions when selling your home. By adapting to changing conditions, you can navigate the challenges of the market and successfully sell your home, regardless of where interest rates stand.

In the next post we will take a retroactive look back through the last couple years of this rate hike cycle and try to see what that could tell us about 2025 and beyond.