23 Sep Interest Rates, Is This Time Different?

The U.S. Housing Market from 2022 to 2024: Trends, Challenges, and What Lies Ahead

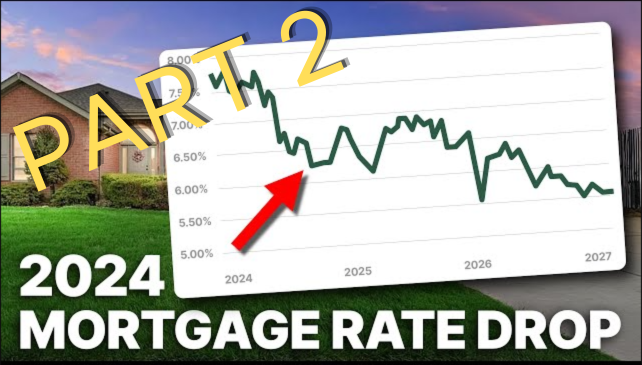

Post 2 of 2

The U.S. housing market has experienced dramatic shifts over the past few years. From the soaring prices of 2022 to the demand cooling effect of rising interest rates in 2023 and beyond, the housing market has been anything but predictable. Whether you are a homeowner, investor, or prospective buyer, understanding the trends and challenges from 2022 to 2024 is essential to navigating the real estate landscape.

In this blog, we’ll take an in-depth look at the U.S. housing market from 2022 to 2024, explore the factors influencing it, and offer insights into what the future might hold.

2022: The Year of Rapid Growth and Frenzied Buying

The housing market in 2022 was a continuation of the unprecedented growth seen in 2020 and 2021, largely driven by a combination of low mortgage interest rates, high demand, and limited housing inventory.

Key Factors Driving the 2022 Housing Boom:

- Low Interest Rates: Throughout 2021 and into early 2022, mortgage rates remained near historic lows, hovering between 2% and 3%. This created an environment where homebuyers could borrow more money at lower costs, fueling home purchases.

- Pent-Up Demand: The COVID-19 pandemic led many buyers to reevaluate their housing needs, resulting in a surge in demand for single-family homes, especially in suburban and rural areas. Remote work opportunities also allowed people to move away from expensive urban centers.

- Limited Inventory: Even as demand for homes skyrocketed, the supply of available homes remained tight. Many homeowners hesitated to sell amid the uncertainty, and new construction couldn’t keep up with the increased demand.

Consequences of the 2022 Housing Boom:

- Rising Home Prices: Home prices surged throughout 2022, with many markets seeing double-digit percentage increases. Buyers found themselves in bidding wars, offering well above asking prices, and sellers were in a prime position to dictate terms.

- Affordability Challenges: As home prices rose rapidly, affordability became a significant concern, especially for first-time homebuyers. Even though interest rates were low, the steep home prices began to stretch the budgets of many buyers.

2023: The Market Cools Amid Rising Interest Rates

The U.S. housing market took a sharp turn in 2023 as the Federal Reserve aggressively raised interest rates to combat inflation. This led to a cooling in the housing market as higher borrowing costs began to weigh on buyers.

Key Trends in 2023:

- Rising Interest Rates: In response to inflationary pressures, the Federal Reserve implemented a series of interest rate hikes throughout 2022 and into 2023. By mid-2023, the average 30-year fixed mortgage rate had risen to above 7%, drastically reducing buyers’ purchasing power.

- Decreased Buyer Demand: Higher mortgage rates meant higher monthly payments for new buyers, leading many to postpone their home purchases or lower their budget expectations. As a result, the previously red-hot housing market cooled considerably.

- Stabilizing Home Prices: While home prices remained high, the rate of appreciation slowed. In some markets, prices began to level off or even decrease slightly, particularly in areas that had seen the most significant price spikes in 2021 and 2022.

The Market Still Maintained a Seller’s Market:

- No Negotiation Power for Buyers: As the demand for homes retracted, paradoxically so did the supply for homes even more so. The reason for this is actually quite understandable. When a homeowner decides to sell their home, often they are also in the market as buyers. Whether their reason is to sell because they are relocating or simply just downsizing, often the sale of their home is paired with another purchase elsewhere. With the extremely low interest rate environment of 2020-2021, this created an environment in which 80% of the mortgages currently held in the US were lent at around a 3% interest rate. This was due to the refinancing frenzy post-COVID, when most homeowners took the opportunity to refinance at historically low rates. So we saw an extremely rare time in which supply contracted faster than the buy-side demand cooled off. This created an environment where buyers still had little to no negotiating power and often were competing in multiple offer situations.

- Decreased Housing Inventory: Inventory levels were very low compared to historical norms, many homeowners did not want to give up their 2-3% interest rate they were paying with their current mortgage and swap it with a new purchase with a mortgage rate over 7%. Additionally in almost every region in the US the home prices have appreciated so much that in many cases sellers found themselves doing the math and found that if they would sell their home now, they would end up paying a lot more per month on their mortgage for their new house, even in situations where they were downsizing. The proposition to sell now, and pay a lot more for less house did not appeal to most homeowners so they simply made the decision that this is not the time to sell.

2024: Uncertainty and Gradual Stabilization

As we look into 2024, the U.S. housing market remains in a state of transition. Interest rates are still a key factor, but several other macroeconomic conditions are influencing the market.

Key Trends Shaping the Housing Market in 2024:

- Moderate Interest Rates: After the aggressive rate hikes in 2022 and 2023, in Sept. 2024 the Federal Reserve has made the first rate cut which lowered their Fed Funds rate by 0.25%. Additionally, they have signaled that more interest rate cuts may continue in 2024 and 2025, depending on inflation trends. However, mortgage rates remain elevated compared to the historically low rates of 2021-2022, hovering around 6% this is expected to lower if the Federal Reserve continues to lower the Fed Funds rate.

- Slowdown in Home Price Growth: By 2024, home price growth has stabilized, with most markets seeing only modest increases or even flatlining. Some regions, particularly those that experienced the most dramatic price hikes during the pandemic, may see slight price declines as supply and demand continues to normalize.

- Buyer Hesitation and Affordability Issues: Affordability remains a concern for many buyers. Higher interest rates mean higher monthly payments, and despite slower price growth, homes are still expensive relative to pre-pandemic levels. This is particularly challenging for first-time buyers who are navigating the higher costs of living and stricter mortgage qualification standards.

- Shifts in Buyer Preferences: As remote work becomes more entrenched, many buyers are still prioritizing space and affordability over proximity to urban centers. This trend, which started during the pandemic, continues to shape demand in suburban and exurban areas.

Supply and Demand Dynamics from 2022-2024

Supply-Side Conditions:

- Limited Housing Supply: One of the defining characteristics of the housing market from 2022 to 2024 has been the persistent shortage of available homes. New construction has been slow to catch up with demand, exacerbated by supply chain disruptions, labor shortages, and rising construction costs.

- Homeowners Staying Put: Many homeowners who locked in low mortgage rates during the pandemic are reluctant to sell and take on a higher rate for a new mortgage. This has contributed to the limited supply of homes on the market.

Demand-Side Conditions:

- Strong Buyer Demand in 2022: The demand for housing remained strong throughout 2022, driven by low interest rates and the desire for more space. However, demand began to taper off in 2023 as interest rates rose.

- Cooled Demand in 2023-2024: Rising mortgage rates significantly reduced buyer demand in 2023. While some demand remains, particularly in affordable housing markets, many potential buyers are sitting on the sidelines, waiting for more favorable conditions.

Regional Variations in the Housing Market

The U.S. housing market from 2022 to 2024 has not been uniform across all regions. Some areas have experienced much more dramatic shifts than others.

Hot Markets:

- Sunbelt States: States like Florida, Texas, and Arizona saw significant population growth during the pandemic, driven by migration from more expensive coastal areas. These regions continued to experience strong demand in 2022, though price growth began to slow in 2023 and 2024.

- Suburban and Exurban Areas: The pandemic fueled a shift toward suburban living, as many buyers sought larger homes and outdoor space. This trend has persisted, though suburban markets have cooled as interest rates rose.

Cooling Markets:

- Coastal Cities: High-cost cities like San Francisco, New York, and Los Angeles saw a slowdown in price growth, and in some cases, modest price declines in 2023 and 2024. Affordability concerns and the continuation of remote work have led some buyers to look outside of these urban centers.

What Lies Ahead for the U.S. Housing Market?

As we move through 2024, the future of the U.S. housing market remains uncertain. Much will depend on macroeconomic factors like interest rates, inflation, and the broader economy.

- Interest Rates and Inflation: The direction of interest rates will be one of the most critical factors shaping the housing market. If the Federal Reserve succeeds in taming inflation, we could see mortgage rates stabilize or even decrease slightly, which would help boost buyer demand.

- Affordability and Supply: Affordability will continue to be a significant challenge, especially for first-time buyers. While home prices are stabilizing, higher interest rates make it harder for many buyers to afford homes. Addressing the supply shortage through increased construction will be key to balancing the market.

Final Thoughts...

The U.S. housing market from 2022 to 2024 has been a story of extremes. After the frenzied activity of 2020-2022, the market began to cool in 2023 as interest rates rose, and by 2024, the market was in a state of transition. While some regions are seeing more stability, challenges like affordability and inventory shortages persist. If mortgage rates continue to go lower, this might be the biggest factor in causing major shifts in the market. For buyers and sellers alike, understanding these trends is crucial to making informed decisions in a constantly evolving housing market.