04 Mar Understanding Foreclosures

Have you been unsettled by headlines highlighting a surge in foreclosures within today’s housing market? Before succumbing to alarm, it’s essential to recognize that these attention-grabbing titles often lack the full narrative.

Putting Foreclosure Headlines in Context

Media reports exaggerate the significance of recent foreclosure upticks by comparing them to historically low periods. This is a common trend amongst the media, as they will try to exaggerate any subject if it means that they get more clicks, views, and the possibility of creating buzz around the world.

Nonetheless, when viewed against broader market trends… the situation appears less dire.

Navigating Post-Moratorium Dynamics

The temporary reprieves provided by moratoriums and forbearance programs in 2020 and 2021 allowed countless homeowners to stabilize their finances amidst unprecedented challenges. With the conclusion of these measures, an anticipated increase in foreclosures followed, but this alone doesn’t signify housing market distress.

Analyzing Long-Term Trends

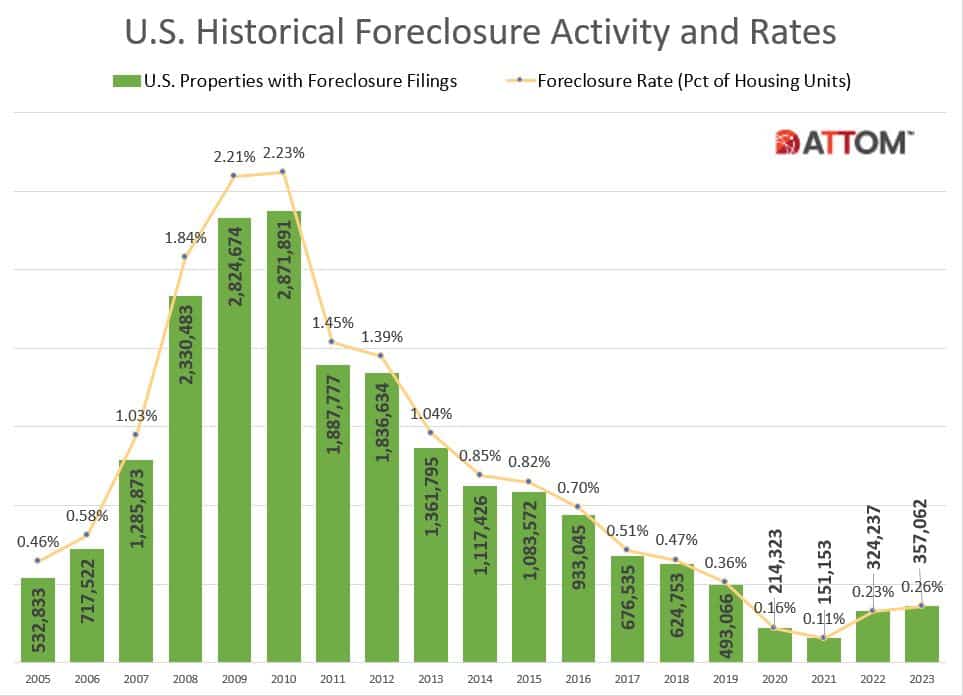

Rather than fixating solely on recent anomalies, examining long-term data is prudent, particularly in comparison to the 2008 housing crash. Data from ATTOM indicates that while foreclosure filings have risen, they remain significantly lower than pre-crash levels.

Dispelling Foreclosure Crisis Fears

Despite the uptick, statistical evidence refutes claims of an impending foreclosure crisis. The housing market is far from the turmoil witnessed during the bubble burst.

The Bottom Line

Although the housing market is witnessing an anticipated rise in foreclosures, it’s essential to distinguish this from the crisis levels of the past. Consulting a real estate agent is recommended for accurate insights into housing market dynamics.

Do you want to start your next Real Estate adventure?

Do you have any questions related to Real Estate and our current market?

Don’t wait any longer!

Contact a member of The Haghkar Group today!

cover image source- ATTOM